Course Information

- Course Description

- Course Rosters

- Syllabus

- Course Applications

- Waitlist

- Courses FAQ

- Midterm Information

- Final Exam Schedule

Finance Major Requirements

- Faculty Information

- Faculty Office Hours

- New Faculty-Fall 2009

- Faculty Recruitment

- TA Information

- TA Office Hours

Dept Information

- Recruiting Seminars

- Macro Seminars

- Micro Seminars

- Brown Bag Seminars

- PhD Main Page

- PhD Job Market

- Assets Workshop

- Finance 101

0 Balance Transfer Cards

CORPORATE RESTRUCTURING

The objective of this course is to familiarize students with the financial,

legal, and strategic issues associated with the corporate restructuring process. I know people who have used 0% APR balance transfer offers in order to get ahead on larger loans like college student loans, home equity lines of credit, and even car loans. He is a long-term market follower, financial educator and especially interested in looking at money from a biblical point of view. View monthly repayments and interest monthly car payment to fix rates for our loans. For additional options, please see our ranking of the top 10 balance transfer offers of 2012 here. Then ask if the way payments are allocated can change 0 balance transfer cards completely once you are out of the 0% period.

Prerequisites for this course are next to none. They will credit your payment to the 0% APR and leave the 19.99% purchases to revolve. If you spend $500 in the first three months, then the $100 cash back bonus will help cover the balance transfer fee of 3% upfront or $5, whichever is more. This MBA course and registration will be through the MBA Auction.

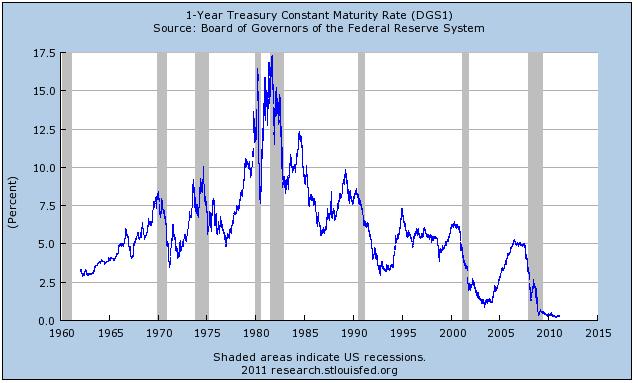

MANAGING FIXED INCOME SECURITIES

Our professors offer "Managing Fixed Income Portfolios" course this coming spring. How that account is managed after the transfer is what will make the difference in how much money is saved over the course of the zero interest period. By doing this, your payments will go 100% towards the principle for the length of the 0 balance transfer cards introductory period and you can make huge progress on paying down your balance. They change constantly and I have reported what I believe to be the most accurate information. If the balance is great, we must focus to balance transfer in order to pay off debt.

If you have, for example, an $8000 balance, you would need to make credit card payments of over $1330.00 per month in order to have that balance paid off within a six month promotional period. In the event that there is still a balance remaining on the transferred balance as this time period comes to a close, it may be possible to open a 0% balance transfer credit card with another company, and continue the cycle further. Prerequisite for this course IS Fixed Income. When the government changed the rules on credit cards a few years ago, they made a rule that payments have to be credited to higher-APR balances before lower-APR balances. The professor will teach one MBA section and one Undergraduate section.

The most basic and practical use of 0% APR balance transfer offers is to pay down high interest credit card balances more quickly. We make every effort to maintain accurate information.

PRIVATE EQUITY FINANCE

The course will be a survey of the private equity asset class. How to write a hardship letter free hardship letters what your lender looks for. However, some companies will charge incredibly high rates after the end of the initial period with no interest. My real-estate guy says all my credit card balances hurt my credit score.

The course topics will follow the private equity cycle by studying representative transactions in the U.S., Europe, and emerging markets.

The savings account interest rate needs to higher than the credit card balance interest rate in order to profit. It’s easy to see why.) In any case this rule would seem to make it so you can carry a 0% balance and use the card for ongoing purchases, since your payments will always be allotted to purchases rather than the 0% balance, right. Assuming a 3% balance transfer fee of $30.00, the offer begins to look a bit more attractive. You may pay more in the end, however, your monthly costs become more manageable until you can get back on your feet. I just tried to find the pentagon federal credit union plat cash rewards card. Enrollment for this course is by application only

So, the year 2011 was coming to an end, I have helped my friend by paying off her balance on one of the cards, and wanted to re-allocate her spare (now) line of $6K to her other account. So, if you were able to pay $200 a month on your $8000 balance, at the end of six months you would still have $6800 remaining on your card. The offer permits you to transfer balances from other credit cards onto the new card at an amount up to your credit limit.

You also get 0% Intro APR on purchases for 18 months too. The debt free feeling is your goal and it is priceless so you will have to work hard to get it. The 0% balance transfer tactic worked well, with each card earning a couple hundred dollars before taxes with minimal effort. This is quite a bit more then the $240 balance transfer fee you would pay.

Toyota Carro De Segunda Mano

First, a customer opens a new credit card account that offers a 0% interest balance transfer program. Doing this four times a year I put aside $12,000.00 at the expenses of $360.00 a year, but with the points from the cards to lower this fee. They can lower your rate, 0 balance transfer cards and extend your term. In addition, customers would be well advised to pay close attention to the interest rate after the period of zero interest expires. If you carefully plan how much you will pay during the 0% promotional period, it works. When balance transfer rates are high, the only way you can take advantage is through riskier means like investing the money in the stock market, gambling, or using a peer to peer lending site.

Discount Cards Offers In The Phillipines

In my last post about balance transfer arbitrage, I pointed out that banks and credit card companies are once again offering 0% introductory rates on transferred balances. I was considering doing something similar 0 balance transfer cards myself, and you can read about it here. Wells fargo home mortgage loans. Listings of first national bank partnered bank house auctions with south africa s busiest. Cavite pay day loan as much as, cash lending in cavite thousand in quickly time. The best balance transfer credit cards updated daily direct from banks.

Second, check the fee on the balance transfer. The first offer is really best for consumers who are only intending to do balance transfers, as this card offers a long 18 month intro rate on balance transfers, but a very, very short 6 month 0% rate on purchases. We help you compare the best balance transfer credit cards. Sounds like your friend was playing with fire on that one. But as you can understand I’m hardly making a dent paying down the debt bc of the fees.

There are two important things that go wrong with this argument. So you have 0% on purchases for 12 months, your purchase is 2000 + Tax let us say it is 5% so your total is 2100 divide that by 12, you will end up paying $175 per month. The only way to take advantage is to make sure you still try to pay off your debt as quickly as possible. Chase Slate has held the top position on SBT’s monthly balance transfer rankings since April. Before this rule was enacted, we used to get 0% fee, 0% interest offers all the time.

Note that the ‘extra’ principal payment money increases as credit cards disappear, as the minimum payment for the paid off card is snowballed into the principal payment money. The best part is that there is no balance transfer fee upfront if you make your transfer in the first 60 days with this card. I’m still a happy, satisfied client of BofA, but I feel like I have to spread the fair warning to be VERY CAREFUL with this Bank as it got many tricks under its sleeves for unsuspecting customers.

It’s very interesting to read all of information about no fee balance transfers for 15 months or 24 months. Here is how I did it in case someone needs some numbers. This site may be compensated by credit card issuers when a reader applies for a credit card through the links on this site. Then look in this section for the best balance transfer credit cards that offer good deals such as 0% interest for 1 to 2 years, no-fee balance transfers, and lower regular APR rates.

Emergency Assistance

Most credit card company hopes that you will not pay within the intro period so all you need is to be disciplined and disappoint them. Over a one year period of time using the same calculations and assuming the same payment rate, you will pay $42.79 in interest over the course of the year. I recently transferred a balance to a Wells Fargo CC and was surprised to find a minimum monthly fee that is roughly 1% of the balance. I’ve compiled a list of credit cards that have 0% interest rate offers on balance transfers (some offer that promotional rate for purchases too) and published that list below. Some balance transfer offers are considerably longer than others, and in this case, longer is definitely better. This will depend on the amount of money you owe and the interest rate you are currently paying.

If your credit card interest rate is 20%, with all other factors the same, you will pay $96.59 in interest over 6 months and $184.48 over one year. Here are a few choices you should consider. The consumer-protection rules don’t apply to these. You can do this by figuring out how much you can pay per month and subtracting that amount form the total owed. Re using 0% credit card offers to pay off existing 0% credit card balances that are nearing the end of the 0% offer period.

They send me checks to write in the amounts I want, or” balance transfers” with 0% interest. Compare balance transfer credit cards with uswitch balance transfer credit. Explain your situation, and the monthly amount you are able to pay. Although there is some variation on how creditors charge interest – some charge interest on a double month cycle- you will pay approximately $23.37 in interest over a 6 month period.

Dont File Bankruptcy

When deciding what to do about your debt, one common question is how to calculate when using a 0% balance transfer makes sense. Shame on the BofA for mistreating its customers. But if you have bad credit, you may find it los angeles loan without bank account a little difficult to get the money you. While this is a savings, only you can decide whether that amount of money is worth the hassle of transferring a balance. I am one of those very disciplined people, but my problem is that I have been unemployed and racked up credit debt. None of the cards listed on this page have an annual fee so you won’t have to worry about that, but any cards you see somewhere else may have a fee.

Because of higher balance transfer fees and extremely low savings account interest rates in the past couple of years, balance transfer arbitrage became unviable. A 0% balance transfer is a marketing tool used by credit card companies to increase the number of customers holding accounts with them, and also increase the amount of debt held within those accounts. When you are applying for a balance transfer, ask the representative some key questions.

In addition to being the only no fee balance transfer credit card that offers a 0% rate on the market, Chase Slate also offers a very competitive 0% APR for 15 months that applies to both purchases and balance transfers. He has published or written for several blogs and websites over the past decade. In other words, if you have no emergency fund and your cash-on-hand is low, a rolling 0% balance transfer can be a low-cost way to handle a financial emergency – if you are disciplined.

Bad Debt Affecting Credit Score

Interest rates on credit cards can vary widely from around 5% to upwards of 25% depending on your credit score and a number of other factors. These two incidents make me think that BANK OF AMERICA has a DOUBLE STANDARD, where they treat customers like me (who have $00,000 balancesl MUCH BETTER than those who linger around with $000.00 in their accounts. I do occasionally use the ones from BofA, and the bank will just take the amount off the credit card and I wouldn’t have to care about the APR since I plan to pay it a month or two, before the expiration date of the transfer. You are also getting a 0% APR on your new purchases for the first 15 months. Short term loans of up to, instant cash loan instantly approval hours a day. You can learn more below or apply for Simplicity here or Diamond here.

We are taking the extra $450 and applied it to one 0% card at a time, starting with the one that will expire first. Several years ago, it was common to find balance transfer offers where there was no balance transfer fee, no interest, and the user was not charged an annual credit card fee. If you have a $1000 balance, that means that you are paying 5% annually on a $1000.00 balance. The idea was simple in that all you needed to do was apply for a few credit cards offering 0% balance transfers, send the money to a high yield savings account and pocket the difference in interest. I learned it all the hard way, over time, and it has cost me.

Buy A Car With Bad Credit

We also have a 4.99% Pen Fed loan that will 0 balance transfer cards retain that % for the life of the loan. Find out what rate will be charged 0 balance transfer cards on that remaining balance. The sales man knew I had the store credit card and want me to use it so he can give me, I believe a twelve months interest free loan. Joshua Caucutt has a BS in Mathematics and a Master's degree in Nouthetic Counseling. Formerly known as "Stew" at Gather Little by Little, Josh writes under his own name at Money Crashers. You can just pay off the $1,000 and keep the $5,000 at 0%, right.

In addition to the 0% balance transfer for 12 months, there was added incentive to purchase certain types of products using that card in order to gain more points for rewards. While many tend to wait until after the holiday shopping season to seek out balance transfers, the smart consumers searching for good 0% balance transfer cards now will reap the most benefits. Credit card arbitrage happens when a person accesses a large amount of cash through a 0% APR balance transfer, deposits that money in an interest-bearing account, repays the balance before the introductory period is over, and then pockets the profit. I always paid the same way, in full every month, no minimums, no late 0 balance transfer cards payments, and without notice they just lowered my credit line.

We started our refinance process with chase back in early may. Could someone give me information if they know of one or some bank that gives opportunities for American citizens living in Indonesia temporary.

Research Resources

Research Centers

- Financial Institutions Center

- Center for International Financial Research

- White Center for Financial Research