Course Information

- Course Description

- Course Rosters

- Syllabus

- Course Applications

- Waitlist

- Courses FAQ

- Midterm Information

- Final Exam Schedule

Finance Major Requirements

- Faculty Information

- Faculty Office Hours

- New Faculty-Fall 2009

- Faculty Recruitment

- TA Information

- TA Office Hours

Dept Information

- Recruiting Seminars

- Macro Seminars

- Micro Seminars

- Brown Bag Seminars

- PhD Main Page

- PhD Job Market

- Assets Workshop

- Finance 101

Mortgage Appreciation Letters

CORPORATE RESTRUCTURING

The objective of this course is to familiarize students with the financial,

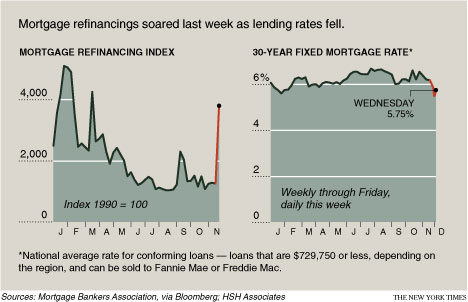

legal, and strategic issues associated with the corporate restructuring process. Champion provides a wide variety of factory-built solutions- from single-family and multi-family modular homes, to commercial and government buildings. Two alternatives might be to use the proceeds from selling the house or refinancing the mortgage to prepay the original loan. Decide if a bad credit loan is the best loans with bad credit borrowing option for you, then use our. I am with CITImortgage and havent gotten any offer yet. These homeowners may have counted on being able eventually to refinance into mortgage appreciation letters loans with terms more affordable than those of their original mortgages.

Prerequisites for this course are next to none. Others may expect fixed mortgage rates to fall. High prepayment rates continued among 2004 and 2005 subprime borrowers. This MBA course and registration will be through the MBA Auction.

MANAGING FIXED INCOME SECURITIES

Our professors offer "Managing Fixed Income Portfolios" course this coming spring. FRMs have been the most popular loan choice in the United States, although the mix has fluctuated significantly. This Economic Letter explores the connections between house prices, mortgage appreciation letters prepayment, and delinquency during the 2001—2008 period. If you fail to log in every three months membership could expire, as Noddle reserves the right to cancel dormant accounts, though users can join again for free if it does. During the housing boom, a shift took place in borrower mortgage choice, with borrowers increasingly opting for ARMs instead of FRMs.

Krainer and Laderman consider the fixed and adjustable-rate borrowers separately. The prepayment incentive increases for 2004 borrowers, but the prepayment rate barely budges. Prerequisite for this course IS Fixed Income. In addition, house prices appear to have influenced mortgage choice indirectly by affecting how borrowers responded to financial market conditions and other aspects of mortgage pricing. The professor will teach one MBA section and one Undergraduate section.

This pattern of weak prepayment in the face of strong incentives suggests borrowers were unable—as opposed to unwilling—to prepay. Indeed, some borrowers may choose adjustable-rate mortgages precisely because they expect to sell their houses before their interest rates reset upward.

PRIVATE EQUITY FINANCE

The course will be a survey of the private equity asset class. Create your business plan executive get your ein online obtain business licenses permits. Of course a decrease in the prepayment rate does not automatically mean that fewer borrowers are able to prepay. Since their peak in mid-2006, house prices have experienced a fall without precedent in the post-World War II era, declining 32% nationwide and more than 45% in markets such as Las Vegas, Phoenix, and parts of Florida.

The course topics will follow the private equity cycle by studying representative transactions in the U.S., Europe, and emerging markets.

They show that, in a housing bubble, decisions about buying real estate and choice of financing could be less systematically linked to fundamentals such as mortgage pricing. The evidence indicates that borrowers purchasing homes in both high- and low-appreciation markets mostly responded as expected in qualitative terms to financial market metrics. To assess whether a declining ability to qualify is causing the fall in prepayment rates, Krainer and Laderman identify a group of borrowers who could have gotten lower interest rates if they refinanced and paid off their mortgages. The increase in ARM shares was most pronounced in markets where house prices rose rapidly. This could cause a change in the kinds of borrowers who choose ARMs. Enrollment for this course is by application only

Shopping is the best place to comparison firestone prices shop for firestone tires. Notably, for low FICO borrowers, the ARM margin was not a statistically significant determinant of mortgage choice in high-appreciation markets. Permission to reprint must be obtained in writing.

For example, Barlevy and Fisher (2011) present evidence that the recent housing boom and bust was associated with a speculative bubble. Our analysis indicates that the pace of house price appreciation had a significant impact mortgage appreciation letters on mortgage choice in high-appreciation markets compared with other markets. The model also includes measures of the average FRM markup based on the interest rate spread between a 30-year fixed-rate conventional mortgage and the 10-year Treasury yield. Thus, if the interest rate incentive to prepay increases, but the incidence of prepayment decreases, a decline in the ability of borrowers to prepay is more likely. For example, although unemployment has risen sharply, it hasn’t increased enough to explain the jump in delinquency rates.

For example, borrowers who took out mortgages in 2003 saw the value of houses in their zip codes increase by about 32% on average over the next two years. Are you a military member, a vet, a family tickets for veterans member looking for a great deal. For example, the mortgage choices of high-risk homebuyers in high-appreciation markets were somewhat less sensitive to the term premium than comparable borrowers in low-appreciation markets.

Rehab Hard Money Lenders

Margins on mortgage interest rates and general financial market conditions have traditionally been important determinants of mortgage financing choice. The expected ARM rate reflects the benchmark’s expected value over the loan’s expected duration, plus the margin. The blue line in Figure 2 plots house price appreciation in the two years following mortgage origination. The prepayment and delinquency trends appear to be associated, with prepayment falling as delinquencies rise. It’s important to stress though that fixed-rate borrowers also find it hard to prepay when house prices drop sharply. Figure 3 shows that subprime borrowers in the 2002 and 2003 origination groups maintained high prepayment rates in the face of weakening interest rate incentives.

Dont Accept Foreclosure

Jun if you have to accumulate charges on plastic your best credit card to launch or build your business,. In addition, Elliehausen and Hwang (2010) show that, unlike FRM margins, ARM margins reflect expected lender losses stemming from the higher default risk associated with the interest rate volatility of these loans. Previous research has shown that interest rates on FRMs and ARMs are key determinants of mortgage financing choice. Similarly, the red line in Figure 2 shows the percentage of loans that became at least 60 days past due within two years. For their part, option ARMs may be especially attractive to borrowers with incomes that vary from year to year. Rapid house price appreciation during the housing boom significantly influenced mortgage appreciation letters homebuyer selection of adjustable-rate mortgages over fixed-rate mortgages.

If at any time within two years after a loan has originated, the market rate on fixed-rate mortgages was at least one-half percentage point below the borrower’s current interest rate, then that individual is identified as a prepayment candidate. Of course, refinancing works only if the new terms are more affordable. Perniagaan Lelaki dan wanita yang melakukan transaksi perniagaan, kami memberikan panjang. So too would financially constrained borrowers with low risk aversion.

House price appreciation is measured as the two-year percentage change in the CoreLogic Home Price Index for the county in which the home is located. The delinquency rate increases beginning with the 2004 loan group, then declines for 2008 borrowers, accompanied by a slight increase in the prepayment rate. But the increase in delinquency suggests that financial distress was also a factor. For the earlier years of the adjustable-rate sample, the relationship between incentive to prepay and actual prepayment rates is what would be expected if it were easy for borrowers to pay off their loans.

It draws on work reported in greater detail in Krainer and Laderman (2011), and complements Hedberg and Krainer (2010), which emphasizes how tighter underwriting standards restrained prepayments in the late 2000s. This practice helps prevent identity theft. This was especially true for subprime borrowers and homeowners with adjustable-rate mortgages. An early study of the crisis by Doms, Furlong, and Krainer (2007) found a strong positive relationship between the rate of house-price depreciation in urban areas and the subsequent rate of subprime mortgage delinquency. The term premium represents the compensation investors require to have their funds locked up for a longer period instead of being put into a series of shorter-term instruments.

The interest rate changes periodically according to market conditions. But in markets with less appreciation, price gains did not influence borrower choices between adjustable or fixed-rate mortgages. One day i tallied up my personal loans need loan to payoff debt and credit cards and realized i was i. The delinquency rate does not begin to tick up until the 2004 group, even though prepayment rates fell for the 2002 and 2003 groups.

Lower prices meant home sales might not raise enough funds to pay off the mortgages. Our process of loan approval is hassle free and fast. Differences in the effect of the ARM margin were evident, especially among borrowers with low FICO credit scores. They first slowed and then fell, leaving many subprime borrowers unable to refinance. To further test the correlation between house prices, prepayment, and delinquency, Krainer and Laderman examine the trend in house prices.

For example, for homebuyers in high-appreciation markets, a 15% house price increase raised the probability of choosing an ARM by about 0.15 percentage point. This muting effect was most apparent in ARM margins, that is, the interest rate spread between ARMs and short-term Treasury yields. In the model, the key determinants of mortgage choice are financial and housing market conditions, and mortgage markups. In such markets, house price gains were strongly correlated with a rising ARMs share for home purchases.

This Economic Letter examines the relationship of housing market conditions during the boom to buyer choices between fixed-rate and adjustable-rate mortgages. Those high rates made subprime loans burdensome in the long run. They take advantage of low initial adjustable rates, expecting to refinance into a lower fixed-rate mortgage than was available when their adjustable loans originated. In markets with high house price appreciation, house mortgage appreciation letters price gains directly influenced mortgage choice.

Mobile Home Lenders For Bad Credit In Tucson Az

House price appreciation slowed for these borrowers. And many borrowers who do prepay have reasons mortgage appreciation letters other than avoiding foreclosure. Both series show that ARMs became more popular during the housing boom, mortgage appreciation letters especially during the years of peak house price appreciation. Still others may wish to capitalize on rising home values by extracting cash to finance large expenses, such as education or home improvements. The thick red line shows the ARM share of mortgages in a random sample of first-lien loans drawn from an LPS Applied Analytics database used in our analysis. The mortgage rates a lender sets will depend on underlying market conditions and other factors.

Find out how debt consolidation loans can help you improve your cash flow, save. Otherwise the loan is classified as being in a low-appreciation market. Falling house prices may have especially impinged on subprime and adjustable-rate borrowers. Those declines have played a key role in the crisis of the mortgage market, which has been marked by surging delinquencies and foreclosures.

Historically, such advances have been characterized by higher levels of interest rate risk and have required more rigorous risk management techniques. But, as Gorton (2008) explains, subprime borrowers who regularly made timely payments were eventually rewarded with higher credit scores. Two general loan types for which your child could be eligible are subsidized and. In aggregate data, prepayment appears to be negatively correlated with market interest rates. At the same time, such house price increases may make it easier for financially constrained borrowers to get credit, to the extent that lenders ease down-payment requirements.

These results are consistent with research showing that higher house price appreciation leads to terms on adjustable-rate mortgages that can be relatively attractive to some borrowers and that financially constrained borrowers tend to prefer such loans. Here the focus is on the adjustable group. Some borrowers who could have avoided delinquency if they sold or refinanced may not have been able to do so.

Research Resources

Research Centers

- Financial Institutions Center

- Center for International Financial Research

- White Center for Financial Research