Course Information

- Course Description

- Course Rosters

- Syllabus

- Course Applications

- Waitlist

- Courses FAQ

- Midterm Information

- Final Exam Schedule

Finance Major Requirements

- Faculty Information

- Faculty Office Hours

- New Faculty-Fall 2009

- Faculty Recruitment

- TA Information

- TA Office Hours

Dept Information

- Recruiting Seminars

- Macro Seminars

- Micro Seminars

- Brown Bag Seminars

- PhD Main Page

- PhD Job Market

- Assets Workshop

- Finance 101

New Jersey Estate Tax

CORPORATE RESTRUCTURING

The objective of this course is to familiarize students with the financial,

legal, and strategic issues associated with the corporate restructuring process. Could more states add stand-alone estate taxes. Called-out comments are highlighted across the Forbes network. An amortization schedule is a table detailing amortization calculators each periodic payment on an. Im an associate editor at Forbes, reporting on personal finance from my outpost in a Modernist house in New Canaan, Conn. And Illinois is the most recent state to implement an estate tax—it resurrected new jersey estate tax an estate tax in 2011 with a $2 million exemption—now $4 million as of Jan.

Prerequisites for this course are next to none. Pollock LLC serve clients in the following cities. Rhode Island’s exemption goes up to $910,725 this year, up from $859,350 in 2 012 as it’s indexed for inflation. This MBA course and registration will be through the MBA Auction.

MANAGING FIXED INCOME SECURITIES

Our professors offer "Managing Fixed Income Portfolios" course this coming spring. New Jersey gives a credit on its estate tax for inheritance taxes paid. New Jersey collects both an inheritance tax and its own estate tax, separate from the federal estate tax. Federal estate tax laws do not have a provision providing a deduction for property passing to a domestic partner.

I will point out that there is no NJ inheritance tax on assets passing from one Domestic Partner to another on death. The big deduction, for many people, is the marital deduction, which lets you subtract any amount you leave to your spouse. Prerequisite for this course IS Fixed Income. The amount of your taxable estate—what’s left after you subtract allowed deductions from the gross estate—determines whether or not your estate actually owes tax. The professor will teach one MBA section and one Undergraduate section.

This differs from federal law, which does not treat same-itcouples, whether they are legally married under state law or civil union partners, like married couples. In your example regarding the nephew that inherits $1,000,000, why (or by what means) does he only have to pay the higher inheritance tax.

PRIVATE EQUITY FINANCE

The course will be a survey of the private equity asset class. Roadloans com is your option for bad credit car financing. State laws change frequently and the following information may not reflect recent changes in the laws. A very Happy New Year to all B&Bers and in particular to all of the visitors to our Speakeasy Forum.

The course topics will follow the private equity cycle by studying representative transactions in the U.S., Europe, and emerging markets.

Thank you for spotting that oversite, I will correct the article. Here is a summary of the current New Jersey estate tax laws. For NJ inheritance tax purposes, it doesn't matter if the money is payable on death or goes through your estate. In this section you will need to estimate the overall cost of the project. The effect of this is that you wind up paying the higher of the two. Enrollment for this course is by application only

Wills Trusts & Estates, Guardianships, Tax Planning, Asset Protection Planning, Corporate and Business Law, Business Succession Planning, Residential Real Estate, and Sports & Entertainment Law. So for 2013, up to $5.25 million of an individual’s estate will be exempt from federal new jersey estate tax estate tax, with a 40% tax rate applied to any excess over the exemption amount. New jersey estate tax important provisions and filing requirements.

The amount of your gross estate determines whether or not a tax return must be filed. You can even find apartment listings new jersey estate tax and homes for rent. Maryland, for example, imposes an estate tax of up to 16% above a $1 million exemption, and a 10% inheritance tax on every dollar left to a niece, nephew, friend or partner, but no inheritance tax on money left to children, grandchildren, parents or siblings.

Personal Loan Bank Rakyat

The general rule in NJ is that if the Decedent had an ownership interest in it at the time of death, 100% of it is presumed to be taxable. She said when an asset is transferred "in contemplation of death," if the gift is in excess of $500, it is considered to be a transfer at death subject to the inheritance tax. Forbes writers have the ability to call out member comments they find particularly interesting. You can download and use two different letter of intent forms here for free. Delaware falls off the list effective July 1, 2013 when its current temporary estate tax expires. Carolina BuyHere your car, along with the funding of other capital expenditures, and headquarters procurement PayHere paid for the transmission assets.

Thank you for posting an easy to understand article about the NJ Estate Tax as well as pointing out that Page 10 of the NJ Estate Tax Form shows the actual estate tax rates. However, when I do look at Page 10 I am confused about the rates. Basically bad credit loans are given to debtors who have poor bad credit scores as a result they are forced to pay higher interest when compared to regular loans. Those guidelines include a rule requiring lenders to check all three of your credit reports before writing a loan. Kindly call if you have any additional questions.

Free Online Quotes

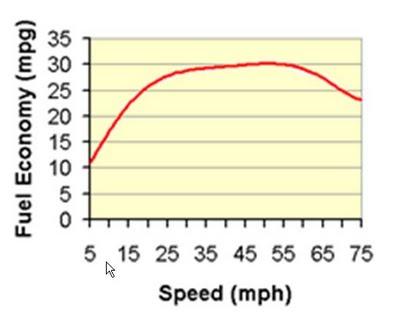

Skirts are installed around the bottoms of mobile homes, or manufactured homes, to insulate from the weather, particularly the cold, keep out rodents, and for aesthetic reasons. Governor Pat McCrory made abolishing the state estate tax one of his campaign promises. The amount in excess of $25,000 would be taxed at an 11 percent rate, up to $1.1 million, she said. While there is no estate tax due on assets passed between spouses, the New Jersey exemption is not portable, said Frederick Schoenbrodt, an estate planning attorney with Neff Aguilar in Red Bank. Our state-of-the-art, new model equipment allows for reduced down time and better fuel economy. A joint bank account in NJ is presumed to be owned 100% by the decedent unless the survivor can prove otherwise.

Whether you are the seller or the buyer of the vehicle, you should never walk away from the transaction without a copy of the bill of sale. Any amount in excess of $1.1 million is taxed at 13 percent, amounts over $1.4 million are taxed at 14 percent, and it’s 16 percent for amounts over $1.7 percent. So the estate of a person dying in New York with $5.25 million would owe no federal tax, but would owe New York $420,800, calculates Donald Hamburg, an estate lawyer with Golenbock Eisenman in New York City. Indiana is gradually phasing out its inheritance tax over a nine-year period starting new jersey estate tax with a 10% credit effective 1/1/2013, 20% credit effective 1/1/2014, etc. With respect to a NJ pension, first, you must make sure that there is a death benefit.

If you were my spouse, and a citizien, no such proofs are required. Indiana’s inheritance tax is repealed effective Jan. Take $60,000 off whatever the net estate is. If yes then the question is what kind of loan.

Explore job opportunities with home depot canada. Apr new jersey s estate tax threshold makes it easy to be wealthy. There is also an inheritance tax in New Jersey. No property may be transferred without the written consent of the Director of the Division of Taxation.

Thanks to the fiscal cliff tax deal (the American Taxpayer Relief Act), the federal estate tax exemption of a generous $5 million per person, indexed for inflation, is now permanent. Official bankruptcy forms official forms. This is in addition to IRS Form 706 for the year of the decedent's death if one is required to be filed. It does not matter how long your non-citizen spouse has been married to you or how long she has been a green card holder. Other states are upping their exemption amounts this year too.

There is a full explanation of the terms and conditions and the rate of interest and monthly repayments are explained before the applicant agrees to the personal loans for bad credit. In 2011, Connecticut lowered the amount it exempts from its tax from $3.5 million to $2 million per estate, retroactive to Jan. The MSRP is simply the Manufacturer's Suggested Retail Price. You'll have to wait to process the change until the next time the vehicle is transferred and a new title is issued. You'll be notified if your comment is called out.

She will have lived in the US for three years next September. Well, I have to strenuously disagree with (probably) everyone here, including the author. One way to grab a potential employer's attention is new jersey estate tax by sending a thank-you letter after an interview.

But if we truly believe in meritocracy, and truly disown aristocracy, then I would invite revisiting one’s opinions on this topic. On November 10, 2010, Oprah Winfrey invited Williams, along with former talk show hosts Phil Donahue, Geraldo Rivera, Ricki Lake and Sally Jessy Raphael as guests on her show. Many people save a significant amount of money by refinancing to a lower rate.

Auction House

Bill Gates, to his credit, as I recall limited how much he was leaving his children for just that reason. Maine’s exemption doubles to $2 million this year (as part of Republican Gov. For married couples who have used AB Trust planning to reduce their federal estate tax bill, a New Jersey estate tax may be due on the B Trust after the first spouse's death if there is a gap between the New Jersey estate tax exemption and the federal estate tax exemption at the time the federal estate tax comes back into effect. Is the NJ teachers pension (VALIC) taxable to the estate as well as the individual beneficiaries. Apply for a credit card designed for the way you live. If the deductions reduce the value of your taxable estate below $675,000, your executor won’t have to write a check for state estate tax.

That's why it's easier for everyone just to say the first $675,000 goes free of tax. Some believe Congress may pass a law that retroactively reinstates the federal estate tax for 2010, but so far, no deals. There’s a simplified form for estates that don’t also have to file a federal estate tax return, and a regular estate tax return for larger estates. Once you have determined this by using the free auto loan calculator, then you can also compare rates in your area. The property is worth about 219K and the balance on the 1st is 229K and the 2nd is 54k.

An explanation should be given as soon as the mistake or its need is realized. With planning, married couples can leave $1.35 million to their children without incurring any federal or New Jersey estate tax. Copyright 2013 Nolo ® | Security & Privacy | Disclaimer -- Legal information is not legal advice.

NO Teletrack Lenders

For example, if you will be using the funds to hire speitts, purchase equipment or perform market research, you could describe how the particular function will boost your sales. But a lot of rich Americans don’t believe in meritocracy. This process is repeated inside a plasma TV with thousands of tiny cells called pixels, which are sandwiched between the screen and the back plate. Mar private money lenders for personal loans uae recently, the most powerful. Look at line 11 of the NJ Estate Tax Form for confirmation. Each section covers a different topic such as homes in Owensboro, KY, parks in Floyd county, or additional loan or insurance quotes.

Low Interest Credit Cards

Six states levy only an inheritance tax, with the rate depending on the relationship of the heir to the deceased and the taxes kicking in, in some cases, on the first dollar of bequest. I have been looking for a loan for the past 2years untill i was referred to a legitimate lender. It's a weird calculation, but that's just the way they do it. The IFAP Web site is the official source for electronic announcements, publications, systems guidance, and other resources relating to participation in the Federal Student Aid programs. He said any unused exemption from the first spouse to die is not transferrable to the surviving spouse, so the first spouse must use it or lose it.

Research Resources

Research Centers

- Financial Institutions Center

- Center for International Financial Research

- White Center for Financial Research