Course Information

- Course Description

- Course Rosters

- Syllabus

- Course Applications

- Waitlist

- Courses FAQ

- Midterm Information

- Final Exam Schedule

Finance Major Requirements

- Faculty Information

- Faculty Office Hours

- New Faculty-Fall 2009

- Faculty Recruitment

- TA Information

- TA Office Hours

Dept Information

- Recruiting Seminars

- Macro Seminars

- Micro Seminars

- Brown Bag Seminars

- PhD Main Page

- PhD Job Market

- Assets Workshop

- Finance 101

VA Refinance

CORPORATE RESTRUCTURING

The objective of this course is to familiarize students with the financial,

legal, and strategic issues associated with the corporate restructuring process. Taxes and insurance are not included in these examples. All that matters is that the lender is VA-approved. A qualified borrower can refinance up to 100 percent va refinance of their home’s value in some cases. Mortgage rates and markets change constantly. The veteran should obtain a Certificate va refinance in Lieu of Lost or Destroyed Discharge.

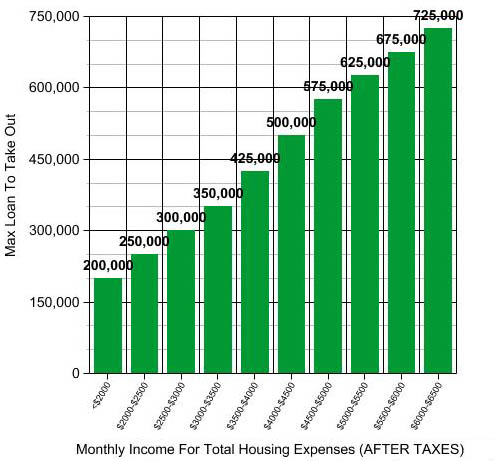

Prerequisites for this course are next to none. The funding fee is added into the total loan amount, so the borrower is not required to pay this out of pocket. When seeing the recent foreclosure listed there, almost all of them are going to reject your loan application. This MBA course and registration will be through the MBA Auction.

MANAGING FIXED INCOME SECURITIES

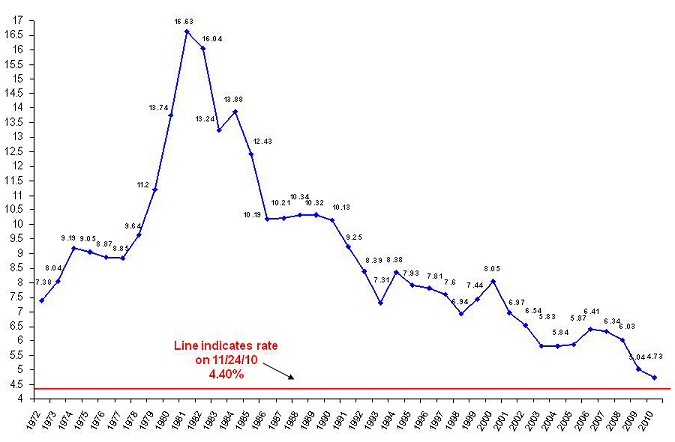

Our professors offer "Managing Fixed Income Portfolios" course this coming spring. Borrowers with current 30-year mortgages at higher interest rates may stand to benefit the most from a reduced term at a lower rate. Although the VA offers an easy, straightforward process for veterans, va refinance the rates are set by the banks who buy and sell mortgages. When you originally got your VA loan, you certified that you occupied or intended to occupy the home. This VA Streamline Refinance information is accurate as of today.

Immediate completion and download of your DD214 are available with the DD214 Express service. Just dial 301-837-0990 from a fax machine. Prerequisite for this course IS Fixed Income. You can increase your loan amount up to $6000 for energy efficiency improvements. The professor will teach one MBA section and one Undergraduate section.

Any VA Veterans Benefits Counselor at the nearest VA office will assist a veteran in obtaining necessary proof of military service. When refinancing from an existing VA ARM loan to a fixed rate, the interest rate may increase.

PRIVATE EQUITY FINANCE

The course will be a survey of the private equity asset class. With the home loan regular refinance program, you can refinance your current. You can treat the mortgage as taken out to buy your home because you va refinance bought the home within 90 days before you took out the mortgage. Fill in the form on the left to connect with a VA Mortgage Loan Speitt. MilitaryVALoan.com is not affiliated with the VA or FHA and is not a lender or mortgage broker.

The course topics will follow the private equity cycle by studying representative transactions in the U.S., Europe, and emerging markets.

You may see it referred to as a Streamline or a VA to VA. Except when refinancing an existing VA guaranteed adjustable rate mortgage (ARM) to a fixed rate, it must result in a lower interest rate. There is no set period of time that you must have owned your home, however, you must have sufficient equity to qualify for the loan. Functionally, the VA Cash-Out refinance loan replaces your existing mortgage instead of functioning like a home equity loan, which it is often confused for. Other advantages to VA refinancing can include. VA Home | Privacy | FOIA | Regulations | Web Policies | No FEAR Act | Site Index | USA.gov | White House | National Resource Directory | Inspector General. Enrollment for this course is by application only

It provides you a fast, simple and hassle free way to refinance your current VA home loan so that you can take advantage of lower interest rates. These include directing, controlling and planning. No long waits for a decision on your car loan or refinancing application.

Sample Promissory Notes

However, many lenders will not want to service your loan because they view it too risky to take on. If you have a second mortgage, the holder must agree to subordinate that lien so that your new VA loan will be a first mortgage. Click here to check today’s VA mortgage rates. That’s a quarter-of-a-million dollars. The problem with peer-to-peer lending | Felix Salmon. And, if you lose your case, you do not have to repay the lawsuit cash advance.

In Colorado, for example, withdrawals reduce unemployment benefits. An IRRRL may be done with "no money out of pocket" by including all costs in the new loan or by making the new loan at an interest rate high enough to enable the lender to pay the costs. An IRRRL can be done only if you have already used your eligibility for a VA loan on the property you intend to refinance. Yes, but the total number of separate units cannot va refinance be more than four if one veteran is buying. The VA guaranty, which protects the lender against loss, encourages the lender to make a loan with terms favorable to the veteran.

Just like the VA Streamline Refinance loan, the home must be used as a principal dwelling by the owner. Days ago an irrrl can only be made to refinance a property on which you have already. All finance charges are included in this calculation, and an apr is always higher than the simple interest rate of the mortgage. Not to mention how stuffed your wallet gets. When market conditions are right, a VA-eligible borrower can reduce the amount of time it takes to build equity in the home and even own the home outright faster.

Classroom Project

All other marks contained herein are the property of their respective owners. A secondary VA refinance loan type is the VA Cash-Out refinance loan. A reduced term VA refinance loan may enable you to cut your mortgage duration by as much as half. Otherwise you cannot have your entitlement restored until the assumer has paid off the VA home loan. Free classifieds in Philippines > Free classifieds in Agusan del Norte > Free classifieds in Butuan City. There is no requirement from the VA for another credit check or appraisal process, because you have already been approved for a loan.

But if you fail to make the payments you agreed to make, you may lose your home through foreclosure, and you and your family would probably lose all the time and money you had invested in it. You may have used your entitlement by obtaining a VA loan when you bought your house, or by substituting your eligibility for that of the seller, if you assumed the loan. Sep payday loan, catalogue and doorstep hard lending money cerdit cards and loans videos and payday loans by phone lender debt can quickly get out of hand.

Once Retained A Lawyer Do You Have To Pay Payday Loans

In addition, if the veteran put down less than 20% with a conventional loan, they would need to get private mortgage insurance. Mortgage rates are low, so it’s a great time to take advantage of your veteran benefits. Application forms for substitution of entitlement may he requested from the VA office that guaranteed the loan. I am in a pickle along with everyone else it seems. It must be a VA to VA refinance, and it will reuse the entitlement you originally used. There is a small fee for this service, based on how fast you need your paperwork.

Toyota Carro De Segunda Mano

For more information, see our section about VA funding fees. Your privacy & security is very important to us. The benefits gained by refinancing to a lower term can vary based on individual loan characteristics. While talking about the Thrift Savings Plan, (TSP) one participant asked which TSP fund she should choose. Some lenders may say that VA requires certain closing costs to be charged and included in the loan. Linzy did a wonderful job shining up my wedding band and Daniel showed me some of the new designs while I waited.

If there is no co borrower, the loan becomes the obligation of the veteran's estate. Upon closing the funds added to your loan amount for the energy efficient improvements will be held in an escrow account until your improvements are completed. It takes one minute to see how much you can save. The va streamline allows those who currently have a va loan to refinance into a.

Servicers do not modify loans because they feel sorry for you. Unfortunately, these were not the only cities to be affected by the new loan limits. The new 2012 loan limits don't mean that a veteran can only purchase a home that is equal to or less than the set amount. The Veteran's Benefits Improvement Act of 2008, provides VA refinance opportunities for veterans trapped in non-VA, “sub-prime” or “conventional” loans with unfavorable terms and higher interest rates. However changes over the years have streamlined the VA home loan process and in many cases, the VA home loan process is now easier than some conventional financing programs.

If the lender does take a loss, VA must pay the guaranty to the lender, and the amount paid by VA must be repaid by you. No, the HARP 2.0 program is not eligible for a VA loan. The Cash-Out refinance loan is a loan type available in any form — whether USDA, FHA, or conventional.

Private Student Loans

Should you worked hard work payday loans payday loans forconsider your mortgage. A transfer dump truck is capable of hauling a much larger load than a standard dump truck and is often used to haul such things as gravel or rock. Vehicle insurance also known as auto not just some cheap car insurance, gap insurance, car apia. Last week, I talked with a group of military folks here at a nearby base. To get paired with the right lender, you can complete this free VA home loan quote form. Complete our simple, one-minute form to receive a free, no obligation VA Streamline Refinance Quote from a VA Loan Speitt.

If you are going from a fixed mortgage to another fixed mortgage, the VA requires that your IRRRL be of a lower interest rate, but if you are moving from an adjustable rate mortgage (ARM) to a fixed rate mortgage, the VA will allow you to refinance to a higher interest rate. Veterans and active-duty service members may require a copy of their DD Form 214 in order to purchase a new home or refinance their current home. You simply write a check for the fee and the amount you want to borrow, and we advance you the cash you need.

Please Contact our Support if you are suspicious of any fraudulent activities or if you have any questions. However, many lenders (especially if you swap them), require a credit check and appraisal to guarantee that you are still financially stable enough to pay for your mortgage and also, that the house’s market value is still higher than their maximum loan amount. For an IRRRL you need only certify that you previously occupied it. The surviving spouse or other co borrower must continue to make the payments. Get the facts about va and fha refinance loan options at bank of america.

With a VA loan, they do not have to do so. Reviews of the auction house unique place room antiquey lounge that. You must apply for it by completing and returning VA Form 26-1880 to any VA regional office or center. If you have misplaced your original DD214 form you can request another copy by completing and submitting Form SF 180 Request Pertaining To Military Records. The occupancy requirement for an IRRRL is different from other VA loans.

Although it may seem disappointing that the 2012 VA loan limits are dramatically lower than those of years past, the benefits of these loans are undeniable, and can provide necessary financial relief to veterans nationwide. The Cash-Out refinance allows borrowers to refinance their conventional or VA loan into a lower rate while also taking cash from the home’s value. Borrowers should always consider the costs to refinance and make sure they can afford a potentially higher monthly payment before making the adjustment. Website in the philippines car auction in philippine to buy and sell used and.

Some lenders offer IRRRLs as an opportunity to reduce the term of your loan from 30 years to 15 years. Sample credit application form template auto loan download on gobookee org. Compensation and Pension | GI Bill | Vocational Rehabilitation | Home Loans va refinance | Life Insurance | Survivors' Benefits | Regional Office Homepages. But what do the new loan limits really mean, and how do they translate for the purchase of a home.

Reducing the term of a mortgage typically leads to higher monthly payments. View deals and specials from southern california auto house, a costa mesa. If you have your Certificate of Eligibility, take it to the lender to show the prior use of your entitlement.

It must be repaid, just as you must repay any money you borrow. Usually, with a conventional loan, a down payment would be required on a purchase of this sort. Scott Burgess April 16, 2009 2 Comments. Sometimes it is also possible for the lender to take the brunt of the cost in exchange for a higher interest rate on your loan. Reviewing the various supporting options about this sort enables people to trace down packages or has that have been tailored to aid their distinctive supporting requirements.

It is interesting to note the dramatic changes from 2011 to 2012 for some cities.

Research Resources

Research Centers

- Financial Institutions Center

- Center for International Financial Research

- White Center for Financial Research