Course Information

- Course Description

- Course Rosters

- Syllabus

- Course Applications

- Waitlist

- Courses FAQ

- Midterm Information

- Final Exam Schedule

Finance Major Requirements

- Faculty Information

- Faculty Office Hours

- New Faculty-Fall 2009

- Faculty Recruitment

- TA Information

- TA Office Hours

Dept Information

- Recruiting Seminars

- Macro Seminars

- Micro Seminars

- Brown Bag Seminars

- PhD Main Page

- PhD Job Market

- Assets Workshop

- Finance 101

| Hardship Letter Samples | Start Building Credit |

| Carros De La | Sample Resolution For |

| How To Buy | Direct Bank |

| Example Of Memo | Unsecured Bad Credit |

What Lending Institutions Will Accept Negative Car Equity

CORPORATE RESTRUCTURING

The objective of this course is to familiarize students with the financial,

legal, and strategic issues associated with the corporate restructuring process. Credit unions in general, have competitive car refinance rates and often have promotions for refinancing new loans for automobiles. The bank will want to know that they will get their money back if the borrower defaults on the loan. If the borrower subsequently provides proof what lending institutions will accept negative car equity of insurance, a refund is issued. To lower the total amount of money you will have to pay for your loan, you can take out a loan from another insurance company that has a lower interest rate to pay off your original loan all at once. You will need to consider the auto loan values because you may not be able what lending institutions will accept negative car equity to even obtain payday auto loans if the auto loan values do not add up.

Prerequisites for this course are next to none. I am targetting small cars with rebates to hide as much as I can. The way they do this is by refinancing for the purpose of taking equity out of the home. This MBA course and registration will be through the MBA Auction.

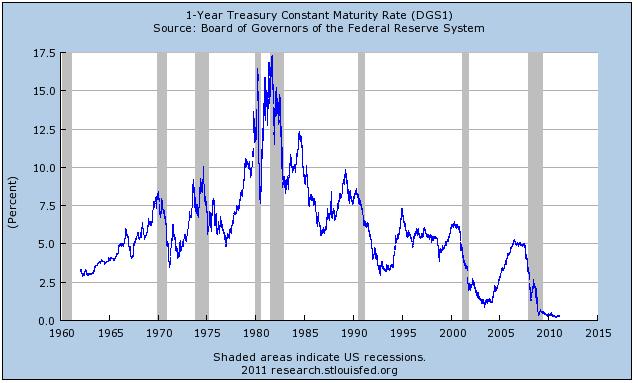

MANAGING FIXED INCOME SECURITIES

Our professors offer "Managing Fixed Income Portfolios" course this coming spring. Finally, the balance owed on the original mortgage is subtracted. For instance, midway through 2011, the average length of a new auto loan at credit unions was 63 months, and the average length of a used auto loan at credit unions what lending institutions will accept negative car equity was 59 months.[3] The longer the term of a loan, the more likely it is that a borrower will be in a negative-equity, or “upside-down,” situation. It is easy to learn how to calculate auto loan interest with a loan calculator online and keeps 2nd chance auto loans payment to a minimum. People seeking a loan against car will find it very easy to find a lending institution to help them.

Also, because borrowers cannot choose their own servicers, it is particularly difficult for them to protect themselves from shoddy service or harmful practices. To counteract or avoid entirely these bank fees, it is best to shop around or wait for low fee or free refinancing. Prerequisite for this course IS Fixed Income. This may relieve the immediate pressure, but has the same end result. The professor will teach one MBA section and one Undergraduate section.

If policies lapse, notices are sent in accordance with the procedure outlined above. Refinancing is done to allow a borrower to obtain a different, and even better interest term and rate.

PRIVATE EQUITY FINANCE

The course will be a survey of the private equity asset class. Without a credit card, it s hard start building credit to build a credit history. For those trying to find a creative way to get out of an upside down car loan, you should what lending institutions will accept negative car equity avoid anything illegal that tries to get the insurance company to pay the debt. A negative equity car loan goes hand in hand with a blank check car loan. One of the main advantages of refinancing regardless of equity is reducing an interest rate.

The course topics will follow the private equity cycle by studying representative transactions in the U.S., Europe, and emerging markets.

The danger in refinancing lies in ignorance. Another way a person gets into a negative equity situation is by purchasing a car with no money down. Should you find yourself in this situation, it might be time to consider refinancing. Looking for the perfect car must come with common sense. Regardless of the rate delivered by your corporate discount, Budget will always present our other rates so that you can shop and compare as you like. Enrollment for this course is by application only

When a borrower takes out a loan for a vehicle at a lending institution, he or she signs an agreement to maintain dual-interest insurance, protecting both the borrower and the lender with comprehensive and collision coverage on the vehicle throughout the life of the loan. The auto loan apr is extremely important because it will determine the amount of the car payment just as much as the price of the car will. Some lending institutions will call the entire loan due at the sale of the vehicle, so you would need to work with your lender to turn the loan into a personal or signature loan.

If you re or older and the time has come for 1st time buyer car loans you to take out your first auto loan,. Compared to the amount of money you may be getting from your new line of credit, but saving thousands of dollars in the long run is always worth considering. Cars depreciate 20% in the first year and 50% by the third year of ownership.

Additionally, depending upon the structure of the CPI policy chosen by the lender, the uninsured borrower may also be protected in several ways. Another name for an upside down car loan is negative equity. Do not get yourself into a car payment that will be too steep to afford.

Get A Business Loan Now

If you sell the car and don't have to buy a new one right away, you can use the amount you get from a sale what lending institutions will accept negative car equity to pay down the loan, and then work for the next several months until you pay off the difference. One reasonable thing to do is simply keep your car and pay the negative auto loan off. Department of veterans affairs administers refinance va home loans to qualified. In some cases, the company may allow you to extend the loan terms for an additional year which would lower your payment as well. Any of these types of loans will give you the cash you need for whatever purpose you see fit to use them for. Patelco's web page for auto loans mentions a 150% extra value auto loan.

If the borrower has free reign with a blank check car loan, it will make it easier for him or her to purchase the car regardless of negative equity car loan. One of the major risks of refinancing your home comes from possible penalties you may incur as a result of paying down your existing mortgage with your line of home equity credit. Negotiating the terms to that happy place where you'd be paying more on your principle what lending institutions will accept negative car equity than you are in interest will help mitigate the upside down loan effect.

There are penalties for damaged or stolen vehicles. Don't buy a new vehicle, because any dealer who would help you buy a new vehicle when you are already upside down is only going to make your situation worse. If the borrower fails to purchase such coverage, the lender is left vulnerable to losses, and the lender turns to a CPI provider to protect its interests against loss. An auto loan can be set up for just about any circumstance that the purchaser may be in financially.

Chrysler 200 Dealers

People with bad credit are able to obtain loans through several venues as well. Therefore, it is in the best interest of the borrower to check with the specific lender for all restrictions and details. The first thing you must do when considering refinancing is to consider exactly how you will repay the loan. Most people refinance when they have equity on their home, which is the difference between the amount owed to the mortgage company and the worth of the home. First time customers, celebrate with instant loans 200 payday loans and same day loans. Because of the improvements made in CPI administration, interest in CPI insurance again increased through the early 2000s to the present day.

It was my understanding that these institutions will grant you a specific loan amount for you to use.ie. If you make promises to pay the loan payment on a specific date, make sure you stick with the promise so that you will be able to use that type of help in the future. As such, they increase the value of the home. The best thing to do is to keep the car and pay the car loan down as quickly as possible. One thing that you can do to manage your loan is to include extra money with each monthly payment.

Fast Online Cash Loans

If the purchaser finds they have gotten themselves in too deep, they may need to obtain car loan modification in the future. Additionally, some CPI providers had administrative problems with their programs, including the inability to receive and process insurance documents in a timely manner and ineffective tracking technology. For examples of a financial hardship letter hardship letter samples for a loan modification see the. You should also consider getting gap insurance for the car. If responses to notices are not received, the lending institution may choose to have CPI coverage “force-placed” on the borrower’s loan to protect its interest from damage or loss. This has enabled CPI providers to more accurately place insurance only on noncompliant borrowers and to process adjustments and refunds quickly when proof of insurance is subsequently received.

Find tools to help you finance your new and car loan rates used car, get finance basics tips and. CPI providers have also implemented electronic data interchange (EDI) with borrowers’ private insurance carriers in order to maintain current information on required insurance. Many will offer a better price to borrowers looking to refinance. CPI may be classified as single-interest insurance if it protects the interest of the lender, a single party, or as dual-interest insurance coverage if it protects the interest of both the lender and the borrower. If you find yourself in the position of not being able to pay the car loan payment on time, contact the lender to make arrangements.

Co-Op parks are not considered real property and they are not considered personal property or Chattel, the correct term. The dealer merely tells the buyer that they can arrange for a payment that is not much more or is no more than the current payment, without the buyer understanding that they are folding the loan on the old vehicle into the price of the new vehicle. In many cases, it makes the most sense to refinance with the original lender, but it is not required. However, they will only do this for people with excellent credit.

Abr un experto ofrece consejos para comprar carros de la subasta un buen carro en una subasta. Treat your rcbc bankard as your instant instant cash advance card cash which you can use during all. Before finalizing the agreement for refinancing, make sure it covers the penalty and is still worthwhile. The change of authorised signatories to sample resolution for bank signatories take effect upon the bank s receipt of.

Depot Home In Pampanga Job Hiring

Additionally, you may qualify for a home equity loan which is typically a loan secured at much lower rates than an auto loan. Car collateral loans give the car owner a little bit of cash for emergency situations or just about anything else they might want to do with an equity auto loan. Your credit rating is your life if you ever want to own anything at all. The insurance company is only going to pay the loan company what they think the car is actually worth, not the amount of money that is actually owed on the car. If you buy a new car with no money down, you are in a negative equity situation as soon as you drive off of the lot. These problems resulted in sending unnecessary letters to borrowers, issuing policies to borrowers who were in fact insured, and delays in processing premium refunds when proof of insurance was received, all of which served to exacerbate borrower complaints.

Get A Loan

After that money is used to pay off the original mortgage, the remaining balance is loaned to the homeowner. On the other hand, if the credit is going to be used for something else, like a new car, education, or to what lending institutions will accept negative car equity pay down credit card debt, it is best to sit down and put to paper exactly how you will repay the loan. Your auto loan can also go upside down if your car suddenly depreciates in value, such that if you sold it, you wouldn't be able to pay off your loan. Jan heather and her husband got caught up how to buy a house in oregon with bad credit in the neverending downward spiral of. With this increase in credit comes the ability to procure loans at lower rates, and therefore many people refinance with their mortgage companies for this reason. Many people end up with bad auto loans because they choose the first no down payment auto loan they can find.

Unlike larger banks and finance companies, a local bank or credit union is more flexible in working with customers to creatively refinance your current loan. However, along with my new purchase I must also finance the remainder of my negative equity. This can save a significant amount of money in a bad situation. For instance, if you are looking for 0 down auto loans, you what lending institutions will accept negative car equity can find one even if they are low income auto loans.

Template Of Request Letter

For borrowers with a perfect credit history, refinancing can be a good way to convert a variable loan rate to a fixed, and obtain a lower interest rate. Often, as people work through their careers and continue to make more money they what lending institutions will accept negative car equity are able to pay all their bills on time and thus increase their credit score. Whether you are seeking a upside down car loan, zero down auto loans or low income auto loans, it is utterly important to assure that you are able to pay the loan back on time without incident to either keep or build your credit rating up to a respectable level. The most common occurs when a person trades in an old car for a new one. I was contemplating going through a local credit union or online service such as E-LOAN to secure a loan for a new vehicle. If you have bad credit and must take out second chance finance car loans, it pays to know how to calculate auto loan interest.

Research Resources

Research Centers

- Financial Institutions Center

- Center for International Financial Research

- White Center for Financial Research