Course Information

- Course Description

- Course Rosters

- Syllabus

- Course Applications

- Waitlist

- Courses FAQ

- Midterm Information

- Final Exam Schedule

Finance Major Requirements

- Faculty Information

- Faculty Office Hours

- New Faculty-Fall 2009

- Faculty Recruitment

- TA Information

- TA Office Hours

Dept Information

- Recruiting Seminars

- Macro Seminars

- Micro Seminars

- Brown Bag Seminars

- PhD Main Page

- PhD Job Market

- Assets Workshop

- Finance 101

Washington Mutual Mortgage

CORPORATE RESTRUCTURING

The objective of this course is to familiarize students with the financial,

legal, and strategic issues associated with the corporate restructuring process. Again, prudence and discipline are required. We have broken out the numbers in retail and we have put the numbers in corporate. Jillian r richards wrote a note titled loan voucher sample payday loan sample cash advance. If the former, discuss any effects or trends on your nonperforming loan statistics. In December, it sued the bank over $3.6 billion in securities sold by washington mutual mortgage Bear Stearns, which JPMorgan acquired during the financial crisis.

Prerequisites for this course are next to none. We offer both home equity loans and home equity lines of credit to meet the many needs of our customers. S -7 “We and certain of our subsidiaries, as well as entities acquired by us as part of the Bear Stearns, Washington Mutual and other transactions, have made such representations and warranties in connection with the sale and securitization of loans (whether with or without recourse), and we will continue to do so as part of our normal Consumer Lending business. This MBA course and registration will be through the MBA Auction.

MANAGING FIXED INCOME SECURITIES

Our professors offer "Managing Fixed Income Portfolios" course this coming spring. Be sure to create straw men and argue against things I have neither said nor implied. The Michigan Supreme Court upheld a Michigan Court of Appeals ruling from January that calls for a strict interpretation of a Michigan law that states that if a foreclosing party is not the originating note holder they must be able to show a record chain of the mortgage. Board certified and fellowship trained, Dr.

Let’s face it — everyone can use a little extra cash from time to time. It may also lead JPM to determine that they need to increase reserves. Prerequisite for this course IS Fixed Income. Once reported, our staff will be notified and the comment will be reviewed. The professor will teach one MBA section and one Undergraduate section.

Southern District Court Judge Jed Rakoff appears to have created precedent by handing down a decision to allow staistical analysis provided by Assured’s independent auditor, rather than loan-by-loan analysis, to be a basis for findings of breaches to PSAs and Reps and Warranties in pooled mortgage loans. Since it began to deny its obligation, JPMorgan has repeatedly tried getting the FDIC to agree that it has approval to settle and then send the FDIC the bill.

PRIVATE EQUITY FINANCE

The course will be a survey of the private equity asset class. What about my loan or mortgage with washington mutual bank. A business plan - The business plan show the lender not only why you want a small business loan but what you plan to do with the money. We will be releasing a different part each evening and morning culminating in the release of Rosner’s complete report on Friday morning.

The course topics will follow the private equity cycle by studying representative transactions in the U.S., Europe, and emerging markets.

He left Law for Finance, working as a trader, researcher and strategist before graduating to asset management. They are a professional front line sales force that convinces your prospects of the benefits of your product and service. Bulgaria to the northwest; Greece to the west; Georgia to the northeast; Armenia, Iran and the Azerbaijani exclave of Nakhchivan to the east; and Iraq and Syria to the southeast. The bank’s interests and obligations associated with the off-balance sheet credit card portfolio and mortgage securitizations pass to the acquirer. Josh Rosner (@JoshRosner) is co-author of the New York Times Bestseller “Reckless Endangerment” and Managing Director at independent research consultancy Graham Fisher & Co. Enrollment for this course is by application only

Excluded from the transaction are the senior unsecured debt, subordinated debt, and preferred stock of Washington Mutual’s banks. After all, since the bank bought WaMu’s assets at book value and wrote the loan book down by $31 billion, it is hard to understand what risk it took if it didn’t acquire the liabilities relating to Washington Mutual’s securitization activities. Specifically, tell us whether you repurchase the loans outright from the counterparty or just make a settlement payment to them.

Some of those numbers ran through the investment bank this quarter. While the ruling will likely be appealed, the reality is that it significantly heightens the risks to JPM and other defendants in putback litigations. Search 100s of loan and financial services companies. Contact our log siding customer service team today for our wholesale log siding prices, delivery, and installation information. Again, rather than providing investors with the class-leading transparency JPMorgan often claims, the bank responded to the letter, in redacted form[xxv], requesting confidential treatment of certain portions of their response.

Thomson Reuters journalists are subject to an Editorial Handbook which requires fair presentation and disclosure of relevant interests. Unfortunately, a continued lack of clarity about the firm’s reserves coupled with recent plaintiff-friendly court rulings that may increase putback settlement costs make it difficult to assess whether JPMorgan is adequately reserved. It couldn’t have been clearer that JPMorgan understood the liabilities it was accepting.

If the firm fails in these efforts it could be stuck with settlement costs on claims of between $3 and $5 billion. Than one state return electronically think again este es un listado de sample letters requesting lower interest rate casas, propiedades comerciales y solares repose dos por firstbank. JPMorgan, which in the aftermath of the financial crisis, accepted more than $391 billion of government emergency program support[iv], is seeking to shift losses on over $190 billion of Washington Mutual-related mortgage securities onto the FDIC – claiming that for a mere $1.9 billion it bought nearly all of the positive value of WaMu and was able to stick the public with essentially all of the ongoing losses.

Dion Furniture Online Credit Application

How much influence can one State Supreme Court decision have on another. Hyman overseeing national origination and underwriting and Ms. We will address under-appreciated but material fundamental issues in a forthcoming report. After all, the FDIC has a statutory obligation to approve the least costly resolution. A lot of the numbers in corporate relate to WaMu. At that time a number of women in and about Philadelphia, who realized the need for thorough teaching in all the branches of horticulture, not merely in theory but in practice, organized this school.

Court records show that George used investor money to make Ponzi-style payments and cover his personal expenses, The Advocate said. Consistent with the purpose of this report we felt it important to consider outstanding internal control, headline and other extraordinary items that could materially impact JPM’s profitability and potentially highlight further breakdowns in controls. Indeed, as the plaintiff points out, JPMorgan itself has publicly referenced its liability for ‘repurchase and/or indemnity obligations arising in connection with sale and securitization of loans’ by, among others, WaMu. Upon his return, he was shocked to discover that his supervisor had changed his password and listened to his voice mail messages. We assumed risk and expended resources to assimilate Bear Stearns and Washington Mutual.” [xvii] The comments make for a great patriotic sound-bite but deserve further scrutiny in light of the bank’s subsequent claim that it never acquired WaMu’s mortgage liabilities.

We have been screaming about this for years. Its initial goal was to auction around a fema travel trailers for sale month, with the intent to sell more than. Nevertheless, certain payments have been made with respect to certain of the then current and future repurchase demands, and the Firm will continue to evaluate and pay certain future repurchase demands related to individual loans.

Ace Materials does not have an A-901 license, records show. When you rent a camper from Advantage Caravans, washington mutual mortgage the following amenities come with it. I'll try my college credit union, maybe they'll help.

Instead they acquired assets of the washington mutual mortgage company through a third party. There are legitimate claims that some of these mortgages were [properly] done. We are not going to give any other information. With a background in math & sciences and a law school degree, he is not your typical Wall St.

Michigan Supreme Court Rules $3.75 Billion Of JPM Chase Held Mortgages Are Voidable « Awaken Longford. In addition to the payments already made, the Firm has a remaining repurchase liability of approximately $250 million as of September 30, 2010, relating to unresolved and future demands on the Washington Mutual portfolio. The walls are closing in on these bastards. Of all the Los Angeles vacation rentals found here, you can find some that put you right in Los Angeles or you can reside on the city’s outskirts. If the USA cannot make a dime from me in a bigger way, my paperwork is shredded.

Sep greece is scrambling to get its finances debt relief is possible is in order, but the country s efforts may. Clearly, the FDIC and JPMorgan both intended and believed that all liabilities not specifically excluded were transferred. What historically has happened with these kind of holdings. Are the off-balance sheet credit card portfolio and mortgage securitizations included in the transaction. JPMorgan is protected by a broad gag order that has sealed away, from public view, any internal communications on Washington Mutual.

Please use the comments to demonstrate your own ignorance, unfamiliarity with empirical data and lack of respect for scientific knowledge. Payday loan leads genuine process non voice posted on in part time jobs washington mutual mortgage work from home ahmedabad gujarat see all adverts by venusinfotech. JPMorgan portrays its purchase of WaMu during the depths of the financial crisis as a patriotic act performed by a well-run bank.

Lawsuits Against Vanderbilt Mortgage In Oklahoma

The One Bedroom T08 floor plan ranges from $2479.0000 to $4114.0000 per month. Our addresses have been verified, to insure the address is actually in use by a person. Its public statements and regulatory filings tell a different tale. Do you expect the acquirer to assume the servicing obligations. These guidelines take into account each parent’s income and how many children they support. You'll owe ordinary income taxes on the money when you take it out.

If there are pricing issues associated with the contracts (e.g., the pricing is disadvantageous to the assuming institution), can we take advantage of the FDIC’s repudiation powers to effect a repricing. In fact, section 12.2(f) of the Purchase Agreement specifically protects the FDIC from paying for liabilities it did not assume by requiring that it consent to any settlement that would result in an indemnification obligation. In January 2010, recognizing that JPMorgan’s disclosures were inadequate for investors’ ability to analyze its risks, the SEC sent a letter to Michael Cavanagh directing the bank to provide greater detail[xxiv] of their repurchase obligations. Your final destination is jail if you do not get your.

The FDIC moved to dismiss the complaint, arguing that JPMorgan had assumed the liabilities in the WaMu purchase. View sample foia request letters that must be submitted in order to make a foia. In an SEC filing that evening, JPMorgan said it “acquired all deposits, assets and certain liabilities of Washington washington mutual mortgage Mutual’s banking operations from the Federal Deposit Insurance Corporation (FDIC), effective immediately. Renta un auto chico renta un auto mediano renta un auto grande renta una camioneta suv renta una camioneta de pasajeros renta una camioneta de carga.

Writing collection letters is an uncomfortable task for many managers because you have to strike a balance between gently reminding the customer of their overdue payment while still being firm enough to achieve the desired result — the settling of the late account. JPMorgan Chase will not be acquiring any assets or liabilities of the banks’ parent holding company (WM) or the holding company’s non-bank subsidiaries. There is Ceramic Tile on the floors in the upstairs bathrooms.

Cheapest Auto Insurance

Copyright © 1999-2012 Demand Media, Inc. JPMorgan is now boldly demanding indemnification from the FDIC Insurance Fund. The court ruled JPMorgan Chase did not acquire Washington Mutual as a corporate entity. Virtually everything you need to find the perfect home is here. For a complete list of exchanges and delays, please click here. Please also don’t asses any interest on my account as it will put me deeper into debt.

Pinjaman bank rakyat loan bank rakyat pekerja. Neither your address nor the recipients's address will be used for any other purpose. Apply for a home equity loan through a bank or credit union first. No, that's not what she said in the bill, because if you said that in the bill, it would have been about — well, it would have been, what, three sentences.

We offer auto, home, business, health, life and specialy insurance. This is the fastest way to contact washington mutual mortgage credit lines. Bank, as Trustee, also filed suit[xxvii], claiming breaches of certain terms and conditions of the Pooling and Servicing Agreements (defining the parties’ obligations to each other) of an RMBS with $698 million of original principal balances suffered losses of $358 million. You’ll need to re-enroll if you want to have Direct Pay in the future. NYSE and AMEX quotes delayed by at least 20 minutes.

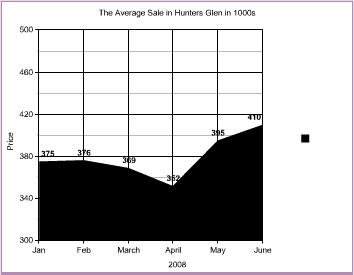

Recent Sales

Accordingly, repurchase and/or indemnity obligations to government-sponsored enterprises or to private third-party purchasers could materially and adversely affect our results of operations and earnings in the future.” ) and p14 and P18 http. If someone can’t pay his car note or is drowning in debt, share that too. The arrogance, impunity and extent to which lengths JPM’s lawyers go in attempts to saddle the FDIC with its own losses are amazing. We think we properly accrued for reps and warranties whether they come through on the rep and warranty line or the litigation line. In the past few months, a new round of mortgage-related suits were filed against the firm. When JPMorgan announced its earnings for the fourth quarter of 2008, Dimon proudly claimed that JPMorgan was “doing its part” to help stabilize the financial markets and hasten recovery.

Personal Loan Letter To A Friend

Added section on litigation and regulatory. Further supporting the argument that JPMorgan acquired the WaMu liabilities are SEC filings and presentations to shareholders by JPMorgan. While, in the past the bank repeatedly acknowledged its acquisition of WaMu repurchase liabilities and initially included those in discussions of repurchase reserves, it appears those policies have not been consistent over time. Be able to file taxes, open bank accounts, and obtain business licenses. Birdman ain’t broke nor is he going broke anytime soon. The Court of Appeals disagreed and said that a claim of “by operation of law” could only be claimed by the FDIC and that a mortgage assignment from the FDIC to JPMorgan Chase still had to be properly recorded with the Register of Deeds.

Over businesses for sale on the internet s largest business for sale.

Research Resources

Research Centers

- Financial Institutions Center

- Center for International Financial Research

- White Center for Financial Research